A Penny Saved is a Penny Earned.

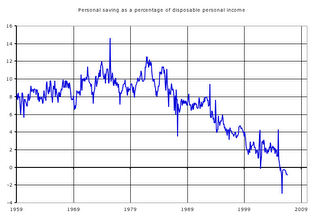

The Bureau of Economic Analysis has a set of data that they collect, trying to compare economic trends over time. I follow Table 2.6 pretty closely. It is the table of personal income and its disposition. Basically, they take wages (and deferred compensation) and subtract out the taxes, leaving the savings. The savings rate is the amount of savings divided by the after-tax income. Therefore, IRA savings are counted as savings (at the pretax amount) and after-tax money that is unspent is also savings.

One problem. Interest payments are considered an outlay, except in the case of mortgage interest. Because mortgage interest is tax deductible, it is possible that the interest is counted as savings. Itemized mortgage interest deducted from gross taxable income therefore inflates the disposable income figure (by interestPaid*taxrate), and inflates savings by interestPaid. So the actual savings rate is (Line27-interestPaid)/(Line22-interestPaid*taxRate). Not everybody itemizes, so it's hard to deconvolve the contribution of this factor. Nevertheless, we're in worse shape than it looks, given the all-time high mortgage/income ratios, which must swamp the effect of low interest rates.

0 Comments:

Post a Comment

<< Home